|

The South Coast of the Gulf of Finland |

|---|---|

| Natural Values and Harmful Installations |

|

Concept of a decommission plan for old nuclear power reactors |

|---|---|

| Guiding Principles from Environmental NGOs |

3. Correctness of economic calculations in the course of taking decision to build a nuclear power plant in the Republic of Belarus

Political decision to build a nuclear power plant in the Republic of Belarus was accompanied by economic calculations and scientific estimates. According to estimates of experts of the Sosny Institute of Power and Nuclear Researches [3], the nuclear sce-nario is cheaper from the point of view of long-term macroeconomic parameters in com-parison with modernization of gas generation, based on combine-cycle plant technolo-gies. According to point of view of the National Academy of Sciences [8], the nuclear power plant stabilizes the cost price of the electric power in the Republic of Belarus en-ergy supply system at the level of US$ 0.13 per kWh rather than the predicted US$ 0.18-0.21 per kWh by 2025-2030 in the “gas” scenario [8].

However, estimates of experts justifying advantage of construction of the nuclear power plant contain a number of basic discrepancies which demands additional calcula-tions and double checking of the received results.

Choosing alternatives. As it is mentioned in [7], for the last 25 years in no coun-tries of the world with market economy any private company has dared investing in nu-clear engineering without support of the state or without granting guarantees of purchase of the generated energy. In Russia the program of support of nuclear engineering pro-vides for allocation of circa RUR 1 trillion (US$ 40 bn. in the 2008 prices).

The guarantee of purchase of the generated energy means that the power supply companies should buy energy of the nuclear power plant, even if it is going to be more expensive than energy of other power plants. This fact best of all testifies that statements about the low cost price of nuclear energy are not always fair.

Comparing cost of construction of nuclear power plants and combined cycle plants. The comparative characteristic of nuclear power plant and combined cycle plants is very important in choosing energy sector scenarios. Economic preference of this or that scenario depends on what primary capital investments are required to develop gas and nuclear generation.

In the proposed nuclear scenario the cost of nuclear power plant is obviously un-derestimated. According to the point of view of experts of the Sosny Institute of Power and Nuclear Researches [3], specific cost of combined cycle plants is almost equal to capital construction cost of the nuclear power plant of US$ 1,116 per kW against US$ 1,126-1,299 per kW for combined cycle plants. At the same time, data for nuclear gen-eration is taken as of 2000 while cost of combined cycle plants is referred to as of 2007-2008 and even this figure is, most likely, overestimated taking into account experience of construction of combined cycle plants in the Republic of Belarus.

Technical and economic characteristics of 30 year old equipment are used for comparison. (Shlyakhin P.N. Steam and Gas Turbines, M, “Energy”, 1974). During this time characteristic of gas turbines and especially combined cycle plants have been im-proving much faster in comparison with “purely” steam ones, including for nuclear power units. World experience of construction of nuclear power plants show that cost of construction of nuclear power units 1.5-2 times exceed the cost of construction of com-bined cycle plants.

By the way, trends of growth of cost of these two technologies, on the example of foreign experience show that this gap increases. For example, according to Cambridge Energy Research Associates Inc. report from 2000 to early 2008 materials for construc-tion of nuclear power plant have grown by 173%, whereas for gas only by 92%.

Growth of cost of nuclear power plant during construction. In the course of con-struction cost of nuclear power plant grows taking into account growing requirements to safety of nuclear power plants, and initially underestimated cost of capital investments. As a result, during construction of the nuclear power unit, which takes 5-7 years, the cost of nuclear generation, grows considerably. For example, the cost of construction of third unit of the Kalininskaya nuclear power plant has exceeded the estimated one by 110% (see Section 4)

Growth of cost during construction is a very important factor in evaluating pay-back and profitability of nuclear projects. So, analysis of sensitivity of the project to in-crease in volume of capital investments into construction of the nuclear power plant (2 power units VVER-1000) is prepared for the second stage of the Balakovskaya NPP. Analysis, executed by authors of the Balakovskaya NPP project has shown that the pro-ject has a net discounted income equal to zero with increase in volume of capital invest-ments into industrial construction by 60% [14]. In case of construction, for example, of the third unit of the Kalininskaya NPP the excess was 110%.

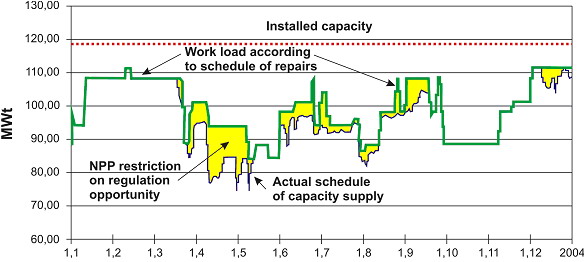

Taking account of natural gas required to increase hot rotating reserve. The nu-clear power plant should work in base mode, and is not designed to regulate capacity of power supply system. In such mode there are no restrictions on speed of dumping load, however, the rise of load is carried out very slowly, by steps with time delay at each step to prevent damage to fuel. Therefore, the number of unloading of units is very limited and intended mainly for scheduled and emergency dumps of loading or stopping units in case of equipment is damaged. According to the National Joint Stock Energy Company “Energoatom”, the number of regime unloading of units of the nuclear power station in Ukraine within the year ranges between 0 and 4 – 6.

Figure 13 - Load of NPP in Ukraine in 2004 in accordance with actual repairs. Source:

Figure 13 - Load of NPP in Ukraine in 2004 in accordance with actual repairs. Source:

website of the “Energorynok” State Enterprise

Now capacity of the largest power units in “Belenergo” is 330 MW. After com-missioning in 2010 of PGU-450 combined cycle plant at the Minsk thermal power plant-5 capacity of the largest unit will reach 450 MW. Construction of the nuclear power plant with 1,000-1,150 MW capacity of power units will demand creation of additional hot re-serve of at least 550 MW.

When equipment is in hot reserve (with 50% of nominal capacity) the consump-tion of fuel increases approximately by 10%, i.e. the 1,000 MW of hot reserve consumes 260,000 tons of equivalent fuel per annum. In this connection it is necessary to introduce a correction into calculation of fuel balance of the republic by quantity of additional gas required to maintain a reserve for the nuclear power plant – circa 140,000 tons of equiva-lent fuel per annum.

Taking account of cost of regulating capacities. Integration of nuclear generation of approximately 25% of total installed electric capacity with share in generation of elec-tric power of 32% is a complex technological task. According to [2], it will lead to com-plexity in passing daily dips, necessity to build special regulating capacities (pumped-storage hydropower plants, heat accumulators, etc.) Cost of regulating capacities, as well, should be considered in the nuclear scenario.

In this situation in Ukraine, operational planners of the State Enterprise “Ener-gorynok” and National Energy Company “Ukrenergo” have to envisage within a year re-strictions of generation of the nuclear power plant, even with minimizing of load on thermal power plants below minimum level – admissible for “survivability” of plants.

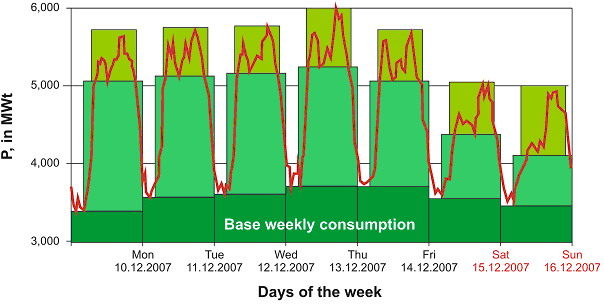

Figure 14 shows that base loading in the Republic of Belarus is circa 3,300 MW. Peak loads show extent of acuteness of future problem of daily and weekly regulation of capacity of gas-fired thermal power plants with commissioning of the 2000-2300 MW nuclear power plant.

Figure 14 - Typical weekly schedule of electric load of united energy system of Belarus in heating season (2007)

Figure 14 - Typical weekly schedule of electric load of united energy system of Belarus in heating season (2007)

Taking into account an average regulating opportunity of condensing plants units at the level of 0.46 construction of nuclear power plant, as well, will require construction of hydro-accumulating power plant of at least 1,000 MW capacity.

Evaluating costs of nuclear power plant tariff taking account of international experience. According to the data provided in [8] with reference to the International Atomic Energy Association, at present, the cost price of electric power, generated by nu-clear power plants in France is € 0.0254 and €0.393 per kWh at discounting rate of 5 and 10% accordingly.

However, in practice it is far from being like this. In 2008 growth of cost of reac-tor under construction in Flamanville (France) by 20% from €3.3 to 4 bn., Areva Com-pany has increased the predicted cost of the marketed electric power from €0.046 to €0.054 per kWh that is obviously higher than the declared of € 0.0254 – €0.393 per kWh.

Concerning cost of energy of the Russian nuclear power plants abroad it is neces-sary to refer to results of the recent tender for construction of the nuclear power plant in Turkey where the Russian company Atomstroyexport turned out to be the only partici-pant of the tender. The Atomstroyexport bid quoted the price of US$ 0.2079 per kWh for the supplied electric power from the Russian designed power units. Even if the discount rate is taken into account the cost price with such supplied price will obviously exceed the threshold of “stabilizing cost price” of US$ 0.13 per kWh. In this connection expert community in the Republic of Belarus should investigate a situation around the tender for construction of the nuclear power plant in Turkey and [find out] the reason of difference between cost price of the Russian designed nuclear power plants in Russia and abroad.

At the same time it is necessary to consider the indisputable fact that growth of nuclear power plants tariff in Russia is restrained inter alia due to numerous subsidies. Underestimation of share of subsidies in nuclear engineering in calculations of the Bela-rusian experts leads to erroneous estimates of the nuclear power plant tariff. Among the schemes of subsidizing of the Russian energy sector it is necessary to allocate at least the following:

- Direct budget subsidies,

- The foreign assistance,

- Tax privileges.

Annually the Russian Federation Federal Budget allocates significant means to atomic engineering within the framework of Programs, like “Safety of Nuclear Industry of Russia”, “Safety of Nuclear Power Plants and Research Nuclear Installations”, “Safety and Development of Atomic Engineering”. In total within the framework of these pro-grams up to RUR 2.5 bn. was allocated annually (data as of 2004). Till 2015 circa RUR 700 bn. of budgetary resources will be allocated solely for construction of new nuclear power plants within the framework of one more program, aimed at development of nuclear complex.

One more example of direct subsidizing, which is possible to refer to, is maintain-ing, at the expense of the state of the internal forces military units providing physical pro-tection of NPPs and nuclear technological cycle objects. It is difficult to evaluate the volume of resources to maintain military units, however to protect each NPP circa one company of internal forces is required. Much more servicemen are needed to protect some of the nuclear technological cycle enterprises. For example, protection of Mountain and Chemical Plant is protected by internal forces regiment.

Within the framework of foreign gratuitous assistance Rosatom receives or re-ceived assistance within the following (but far from limited to) international programs:

- Swedish International Project;

- European Commission ТАCIS Program;

- The USA International Program of Nuclear Safety;

- The Great Britain Nuclear Safety Program

Based on results 2003 activities took place within 152 international projects worth US$ 164 mln. In August, 2003 Finland solely allocated to “Rosenergoatom” circa RUR 300 mln. to improve safety of the Leningradskaya Nuclear Power Plant. In 2003 the German Government has allocated gratuitous assistance up to €7.02 mln. for implement-ing projects on physical protection of nuclear materials in territory of the Russian Federa-tion. According to Chamber of Accounts data, in 1998-2000 more than US$ 270 mln. was received from foreign states and organizations as international assistance to finance activities, related to disposal of radioactive waste.

Due to adoption of the Law “On Exemption of Property Tax of Enterprises, En-gaged in Storage of Radioactive Materials and Radioactive Waste”, amendments have been approved to the Russian Federation Tax Code, according to which organizations, engaged in storage of radioactive materials and radioactive waste, are exempted of prop-erty tax – 2.2% of the real estate cost. Taking into account solely the cost of property of operating storehouses, Rosatom can receive up to RUR 2 bn. of latent subsidies in the form of tax exemption.

Aggregate subsidies, taking into account failure to implement social programs, ac-cording to [16], reduce the cost price of nuclear energy approximately by 30%.

It is possible to state that similar schemes of subsidizing are envisaged in Belarus, as well. For example, according to the recently adopted Law of the Republic of Belarus “On Atomic Energy” it is assumed that “for a nuclear power plant or its unit a fund for decommissioning is formed due to the means received from sale of electric and thermal energy and rendering of other services, and due to other sources, which are not contradicting to the legislation”. Actually the Law opens a way to use budgetary funds to form the fund for decommissioning of the nuclear power plant from operation and other articles of expenditures, typical only for atomic engineering.

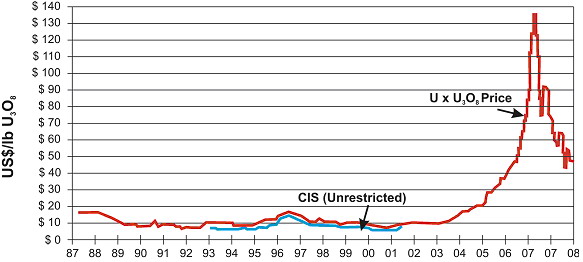

Figure 15 - Change of price of unenriched uranium (protoxide, U3O8) within 20 years till February 2009, US$/lb

Figure 15 - Change of price of unenriched uranium (protoxide, U3O8) within 20 years till February 2009, US$/lb

Evaluating growth of uranium fuel cost. According to [3], researches aimed at optimizing the Republic of Belarus power supply system adopted growth of fuel cycle cost by 0.5% per annum. Cost of fresh fuel approximately by one third is formed from cost of natural uranium. A stable price before, from mid 2003 natural uranium price has sharply grown from US$ 10-12/lb. to US$ 130/lb. by 2007 or more than 10 times (Fig. 15). And though the major growth has fallen on spot market of uranium, nevertheless, contract prices have grown considerably, as well. Shortage of supply in the natural ura-nium market the tendency of accelerated growth of cost of uranium is only becoming more expressed.

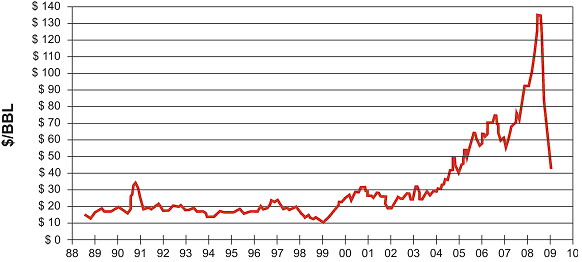

Figure 16 - Change in prices for oil during 20 years, US$/bbl

Figure 16 - Change in prices for oil during 20 years, US$/bbl

Figures 15 and 16 show that since 2004 the price for uranium grew together with oil price, and price for uranium began to fall prior to oil prices – since August 2007. However, if oil price has returned practically to initial condition, prices for uranium have remained at quite high level – as of 9 February 2009 uranium was worth US$ 48/lb. or 4 times higher than prior to 2003. Thus, it is possible to draw a conclusion, that the ura-nium market reflects objective tendencies of uranium price rise, connected with limited offer of uranium in the market.

The last 4-5 years markets of conversion and enrichment of uranium saw a proved significant growth.

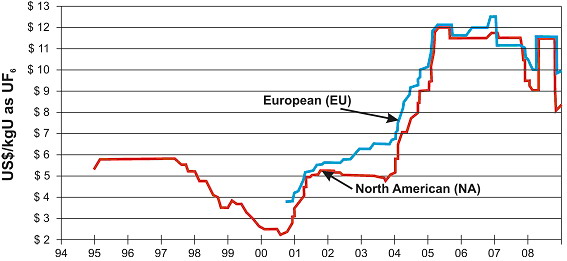

Figure 17 - Change of price for services to convert uranium U3O8 to UF6, US$ per kg UF6 for various processors

Figure 17 - Change of price for services to convert uranium U3O8 to UF6, US$ per kg UF6 for various processors

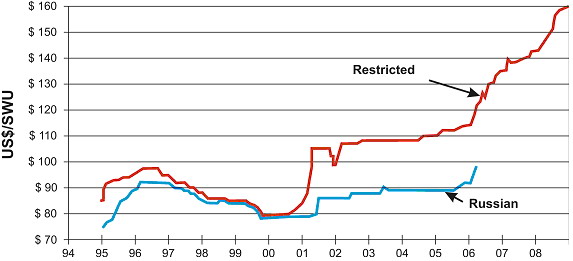

Figure 17 shows that cost of conversion since 2004 has grown from US$ 7 to ap-proximately US$ 10 per kg, an increase of more than 40% during 5 years. Cost of en-richment also experiences spasmodic growth – from US$ 110 to US$ 160 per unit of separation activities (since 2005 growth of approximately 45%).

Figure 18 - Change in prices for services to enrich uranium, US$ per unit of separation activities

Figure 18 - Change in prices for services to enrich uranium, US$ per unit of separation activities

On the background of reduction of prices for oil and natural uranium services on uranium enrichment continue to rise in price.

Evaluation of growth of cost of disposal of the depleted nuclear fuel. Speaking about cost of disposal of depleted nuclear fuel, it is necessary to note that here, as well a steady growth is observed exceeding 0.5% per annum. So, in 2009 Rosatom has in-creased prices for storage and reprocessing of depleted nuclear fuel from the Ukrainian nuclear power plants by approximately 17% from US$ 360 per kg to US$ 423 per kg.

In this connection it is possible to state that in the nearest decades rates of growер of fuel cycle cost at all stages will obviously be exceeding the declared 0.5% per annum.

Choice of discounting rate. In calculations [3], the underestimated discounting rate of 5 or 10% is used. Therefore, the average discounting rate of 7-8% is assumed. It is possible in case the state subsidies are available (construction in the country or preferen-tial export credits). For comparison an average interest rate for loans and credits, ex-tended by the World Bank is 13%.