Reducing Consumption of Natural Gas in the Republic of Belarus: Nuclear and Innovation Scenarios

Authors:

Vladimir Chuprov, GREENPEACE RUSSIA, head of the energy department, Moscow; Russia

Oleg Bodrov, NGO GREEN WORLD chairperson, Sosnovy Bor – Saint Petersburg, Russia;

Igor Shkradjuk, Ph. D., expert of the International Socio-Ecological Union, Moscow, Russia.

The book edition supported by DECOMATOM International Non-Governmental Organization Network www.decomatom.org.ru

Reducing Consumption of Natural Gas in the Republic of Belarus: Nuclear and Innovation Scenarios: monograph. / DECOMATOM – an International Network of the non-governmental organizations for the investigation international experience for the safety decommission of nuclear power plants; Vladimir A. .Chuprov, Oleg V. Bodrov, Igor’ E. Shkradjuk. - Minsk: Bestprint, 2009. 55 pages.

© Vladimir Chuprov, Oleg Bodrov, Igor’ Shkradjuk, 2009.

© «DECOMATOM» – an International Network of the non-governmental organizations for the investigation international experience for the safety decommission of nuclear power plants, 2009.

Executive Summary

In the nearest future the Republic of Belarus, like many other countries of the world will have to take a decision on how its energy sector is going to look like in the coming decades. Energy security and political status of countries would depend on deci-sions taken in this field.

Critical dependence on import of natural gas, which is becoming more and more expensive on 31 January 2008, pushed the Republic of Belarus National Security Council for taking a political decision to build a nuclear power plant.

A number of factors have not been taken into account in the course of taking this decision, which leads to doubts about correctness of the choice.

- Some input data, used for preparing a feasibility study to build a NPP contained errors:

- NPP capital construction unit costs, used in analysis and modeling – US$ 1,116 per kW – were definitely underestimated. In accordance with the Russian Federation Government figures, the cost of capital construction is almost 2 times higher and amounts to US$ 2,140 per kW (in 2007).

- The NPP feasibility study includes data of the International Nuclear Association, according to which cost of production of electric power, generated by NPP in France amounts to € 0.0254 and € 0.0393 per kWh. Figures of the Republic of Belarus National Academy of Sciences say that commissioning of a NPP into energy system of the repub-lic would provide for stabilizing cost of generation of electric power at the level of US$ 0.13/kWh between 2025 and 2030, whereas “gas-powered” option of development of energy system unit costs would rise to the level of US$ 0.18 per kWh in 2025 and US$ 0.21 per kWh in 2030. However, this is far from being the truth. In 2008 due to increasing costs of construction of the reactor in Flamanville (France) by 20% from € 3.3 to € 4 bn. estimated cost of generation of electric energy grew from € 0.046 to € 0.054 kWh. Evaluation of tenders for construction of NPP in Turkey the stated price of marketed electric power, generated by the Russian-design power generating units amounted to US$ 0.2079 per kWh.

- The decision was taken based on economic calculations, which, however, do not take into account some matters of principle:

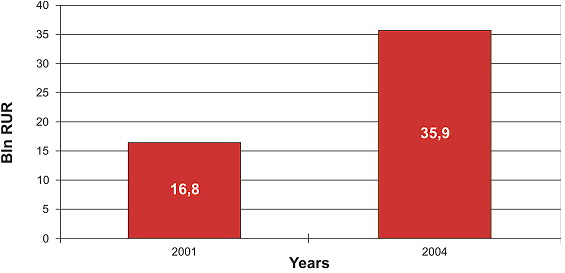

- Experience of construction of nuclear power generating units in Russia proves that real costs are much higher than the initial ones. For example, real costs of construction of the third power generating unit of the Kalininskaya NPP (commissioned in 2004) turned to be more than 2 times higher than the envisaged. On top of this, based on calcu-lations of designers of the second stage of the Balakovskaya NPP, a more than 60% in-crease in volume of capital investments into construction makes erection of water-moderated water-cooled power reactors-1000 unprofitable.

- Growth of official costs per capital investments into nuclear generation consid-erably exceeds inflation indicators : within 7 years costs grew almost 3 times – from RUR 20.2 bn per GW in 2000 to RUR 55.7 bn per GW in 2007.

- Construction of NPP would require erection of non-nuclear capacities for additional non-nuclear hot reserve of 550 MW, which costs circa US$ 0.8 bn. and 1 GW pumped-hydrostorage plant to compensate poor flexibility of nuclear energy sector.

- The need to commission an additional hot reserve, based on natural gas, would result in decreasing NPP efficiency, from the point of view of saving gas, by 0.12 bn. m3.

- Since 2005, following the rise and fall in prices for uranium and oil the cost of uranium in relation to oil and gas saw a two-fold increase. Cost of conversion of uranium in the world market from 2004 grew by more than 40%, since 2005 cost of enriching in-creased by approximately 45%. In 2009 the cost of disposal of used nuclear fuel from Ukrainian NPP in Russia increased by circa 17%. All this evidently exceeds the forecast of 0.5% annual growth in cost of nuclear fuel, used in calculations.

- Reduction of energy consumption, which resulted from economic crisis, makes a decision to build an expensive NPP where the construction would take at least eight years, a quite risky one.

- Construction of NPP would lead only to partial solution of the problem of dependency on gas import. Nuclear generation would ensure replacement of approximately 4.35 bn. m3 of natural gas. Taking no account of natural gas, used as raw material (3 bn. m3) means that absolute reduction of the consumed natural gas would reach circa 23% by 2020 – a reduction of import of natural gas for energy sector from 18.5 bn. m3 to 14.1 bn. m3. Other es-timates say that the reduction would reach 3.51 bn. m3 or 20%. Taking into account natural gas, needed for additional hot reserve the reduction effect would be even lower.

- Construction, operation and decommissioning of NPP result in considerable economic and technological risks that should be considered separately.

- Choosing Russian-made water-moderated water-cooled power reactors-1000 as well, means choosing the uranium fuel supplier. None of the countries with NPPs, built by the Soviet Union was able to change nuclear fuel supplier, which is another proof of monopolistic dependency of Belarus from Russia.

Therefore construction of NPP could only partially solve the problem of replacing the imported gas, creating, at the same time, a lot of new problems, including those for the Republic of Belarus budget, because initially unprofitable nuclear fuel cycle would permanently require subsidies during decades. With presence of alternative less expensive and more secure ways of reducing consumption of natural gas, the nuclear scenario is the most expensive and risky.

Considerable reduction of import of natural gas in midterm perspective (20-30 years) would be possible due to modernization of gas energy sector of the Republic of Belarus and use of renewable sources of energy.

An alternative innovation scenario, proposed in the present note, provides for re-ducing consumption of natural gas in the energy sector by almost 50% from 18.5 bn. m3 to 9.3 bn. m3 with costs per unit of the saved natural gas by 20-40% lower than in the nuclear scenario.

Taking into account the above-mentioned it seems expedient, at least, to post-pone construction of NPP. As maximum, it is necessary to take a decision aimed at development in Belarus of energy sector using renewable sources – by 2020 based on biomass and use of wind potential and solar energy in perspective.

Introduction

Karl Georg Høyer, Professor, Research Director

Oslo University College

This very thorough report by the group of experts reminds us that the most critical issues raised by nuclear power use have a global reach and are just as crucial today as they were some thirty years ago. It is worth remembering that in the 70`s and 80`s even Norway was subject to serious nuclear power development planning. According to these plans Norway by now should have had some 12-15 nuclear reactors localized to 4-5 nu-clear power plants. Due to a strong public opposition this was, at least preliminary, re-jected by the Norwegian Parliament already in 1975. Similar plans were also rejected in Denmark, and the two Nordic countries have ever since kept their roles as nuclear power free zones. In Sweden the Parliament decided gradually to dismantle and phase out all their existing nuclear reactors, a decision very much highlighted in the broader interna-tional discussions. However in the later years it has proven difficult for Sweden to keep to the decision.

Two major nuclear reactor accidents should heavily influence both discussions and decisions. The first one in March 1979. A loss-of-coolant accident (LOCA) took place in one of the two reactors at the Three Miles Island nuclear power plant near Harrisburg in Pennsylvania, USA. Before control was regained the reactor was only a few hours from a fuel meltdown accident. 140 000 people had to leave their homes for shorter or longer time. In its effects, uncontrolled emissions of radioactivity to the ambient envi-ronment, it was not a serious accident. But it demonstrated all the potentials of the ut-most severity. And not the least did it demonstrate the necessity to throw all former quantified risk estimates into the garbage can. In USA the accident lead to a moratorium in commissioning new nuclear reactors. It took 6 years before the Three Miles Island re-actor could start up again, a strong proof of the vulnerability of nuclear power as an en-ergy source if larger or minor accidents happen.

Based on the almost unanimous recommendations from a public commission some industrial actors in the mid 1980`s made efforts to restore nuclear power planning in Norway. Their choice of moment was not very lucky, at least for themselves. 26th of April 1986 reactor 4 in the Ukrainian Chernobyl power plant became subject to the most severe nuclear power accident through all history. As widely recognized extensive land areas and populations both in Ukraine, Belarus and Russia were in particular seriously hit by radioactive downfall. But even as far away as the more remote parts of Norway downfalls were large enough to make immediate counter measures necessary in order to protect population from long term health effects. Now more than twenty years later some of these counter measures are still effective, in particular those that were enforced to counteract radioactive Cesium concentration in reindeer and sheep meat generated through mountain grazing. The total downfall of Cesium 137 and 134 over all of Norway was not a large volume in common terms. In theory it could be kept in a tea cup. On the other hand the amount of radioactivity was very large indeed, and at fairly elevated levels is estimated to be present in Norwegian ecosystems through most of this decennium.

Together with other European countries Norway was taken by surprise. In many ways. It was the large geographical outreach of quite heavy downfalls. Almost all Euro-pean countries became victims, many subject to heavily concentrated downfalls at very large distances from the Chernobyl source. These patterns and distances of radionuclide spreading were very different from the existing models used in risk estimation and con-tingency planning. And there were all the biological concentration chains of the radionu-clides, many never envisaged before, at least as regards their proven importance. Former models and estimates of biological halftimes of nuclides were rejected by hard evidence.

Then there was the accident itself. Most European experts – me included – shared the view that the Russian graphite moderated RBMK reactors were inherently less acci-dent prone than the Western light water moderated reactors (LWR), whether of the pres-surized or boiling type. It was generally accepted that the LWR reactors in principle could be subject to a total, uncontrolled meltdown accident, contrary to the RBMK tech-nology. This was the so called “China Syndrome”, hot fuel melting its way down in the ground visually towards China from USA. We were all taken by surprise of the type and extent of the Chernobyl reactor accident. However not by the release of radioactivity when the accident took place after all. Of course, the lack of the external safety barrier in most Russian reactors at that time, so crucial in Western reactors, was heavily criticized.

The report gives a systematic outline of the other major problems usually connected to nuclear power. They are the safety and deeply ethical problems raised by the continuous generation of long life radioactive waste. Similar types of problems caused by long term decommissioning of various types of nuclear fuel cycle plants, reactors, reprocessing and enrichment units. There are the transport safety issues when linking all the fuel cycle plants and activities together. And not the least are there the inherent and potentially seri-ousness in the connections between nuclear power and nuclear bombs, where the very his-tory of nuclear power was founded more than sixty years ago. Nuclear reactors are still continuously generating Plutonium-239, the isotope applied in the Nagasaki nuclear bomb. And enrichment facilities creating opportunities for the generation of sufficiently enriched Uranium-235, the isotope applied in the Hiroshima nuclear bomb.

In Norway as well as in other European countries the strong opposition against nu-clear power caused energy issues to be focused in new ways, also a great asset of this re-port. The large potentials of new forms of energy production from renewable and envi-ronmentally benign sources, sun, wind, biomass and low temperature heat from the ground, have become crucial parts of the new way of thinking on energy, the “soft energy paths”. And in outlining these paths have also extensive energy saving and gains in en-ergy efficiency played important roles. In the aftermaths of the nuclear power opposition and the many no`s to further nuclear power it was mostly a matter of change of focus in discussion. But gradually it has grown to be an integral part of new politics. And as the future is described today, with the overriding response to issues of climate change, the soft energy paths are taken as the very backbone of all-European energy development and policies. Hopefully this report will give its contribution for the similar paths to become a reality also in Belarus.

1. Structure and Forecast of Energy Consumption in the Republic of Belarus

1.1. Existing Structure and Forecast of Energy Consumption

in Belarus

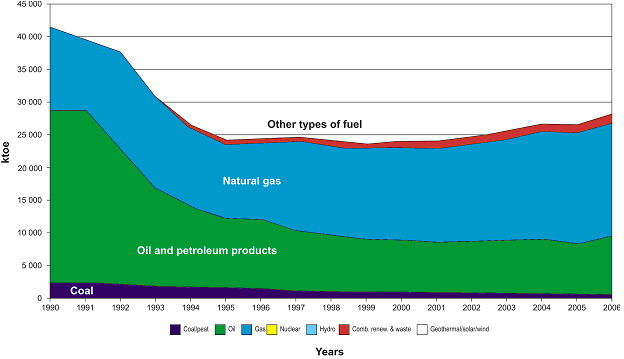

Following collapse of the USSR, energy balance in Belarus has sharply changed to replacement of coal and fuel oil with natural gas.

Figure 1 - Change in structure of consumption of fuel in the Republic of Belarus during 1990-2006, (here 1 ktoe (ton of oil equivalent) = 10.034 GCal = 1.43 tons of equivalent fuel. Source – I nternational Energy Agency http://www.iea.org/statist/index.ht

Figure 1 - Change in structure of consumption of fuel in the Republic of Belarus during 1990-2006, (here 1 ktoe (ton of oil equivalent) = 10.034 GCal = 1.43 tons of equivalent fuel. Source – I nternational Energy Agency http://www.iea.org/statist/index.ht

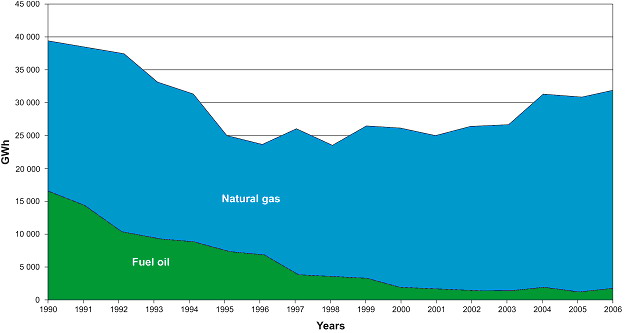

Figure 2 - Change in structure of consumption of fuel for generation of electricity in Belarus in 1990-2006. Source – website of the International Energy Agency http://www.iea.org/statist/index.htm

Figure 2 - Change in structure of consumption of fuel for generation of electricity in Belarus in 1990-2006. Source – website of the International Energy Agency http://www.iea.org/statist/index.htm

Table 1 - Balance of natural gas in 2006. Source – International Energy Agency http://www.iea.org/statist/index.htm

| Mln. tons in oil equiva-lent | Mln. tons of equivalent fuel | Bn. м3 | TJoules | % | |

|---|---|---|---|---|---|

|

Own production |

0,20 |

0,27 |

0,23 |

8458 |

1,1% |

|

Import |

19,12 |

25,65 |

22,30 |

802874 |

|

|

Export |

|||||

|

Change in stocks |

-0,21 |

-0,28 |

-0,24 |

-8805 |

|

|

Total consumption |

19,11 |

25,64 |

22,29 |

802527 |

100% |

|

Consumption in energy sector, including |

14,03 |

18,82 |

16,36 |

589063 |

73% |

|

Condensation Power Plants |

3,94 |

5,28 |

4,59 |

165418 |

21% |

|

Cogeneration (CHP) Plants |

6,29 |

8,45 |

7,34 |

264368 |

33% |

|

Boiler Houses |

3,79 |

5,09 |

4,42 |

159277 |

20% |

|

Losses in transportation |

0,20 |

0,26 |

0,23 |

8226 |

1% |

|

Other branches, including |

4,89 |

6,56 |

5,70 |

205238 |

26% |

|

Industry |

1,71 |

2,29 |

2,00 |

71837 |

9% |

|

Transport |

0,40 |

0,53 |

0,46 |

16646 |

2% |

|

Households |

1,32 |

1,77 |

1,54 |

55384 |

7% |

|

Agriculture |

0,03 |

0,04 |

0,04 |

1352 |

0% |

|

Other |

0,04 |

0,06 |

0,05 |

1777 |

0% |

|

Use as raw materials (oil chemistry) |

1,39 |

1,86 |

1,62 |

58242 |

7% |

In the future, until 2020 natural gas would remain main type of fuel for generation of electricity and heat. However, its share in total fuel oil shall be reduced from the pre-sent 80% down to 60% . Natural gas provides for 95-96% of generated electricity.

The “Belenergo” State Concern is the main consumer of natural gas (58%). Indus-try and transport account for 18% of the natural gas, by the way, a couple of oil and chemistry complex enterprises consume more than half of this volume. 90 cities out of 104 and 60 urban settlements out of 110 are heated by burning natural gas.

As of 01 January 2008 installed capacity of all electric power plants of the “Belen-ergo” Concern amounted to 7,882 MW. Heat power plants generate 98% of installed electric capacity in the Republic of Belarus. In addition to heat power plants the energy system has 26 midget hydropower plants with capacity 10.3 MW and isolated generating units of industrial enterprises with installed capacity of 146.8 MW (as of 2005), planned capacity of isolated generating units by late 2008 amounts to 324 MW.

The specific expence of fuel in the energy system, on average in 2006 was 274.6 grams of coal equivalent per Kwh (taking into account heat supply.

Gas-fired energy sector in Belarus is exceptionally inefficient. Performance index in generating electricity by gas-fired thermal power plant is circa 27%, taking into ac-count that modern technologies ensure performance index in generating electricity of 60% (for condensing plants). Event taking into account considerable share of thermal power plants (more than half of installed electric capacity) efficiency of use of natural gas is poor. For “Belenergo” fuel utilization factor, taking into account effective supply of heat and electricity reaches for CHP – only 76%. However, optimal cogeneration may ensure fuel utilization factor reaching 90%.

Equipment is seriously depreciated, thus about 1,000 MW of capacity are perma-nently under repairs. Taking into account winter heat loads, 330 MW of hot and cold re-serves this results in shortage of capacity reserve.

(The hot reserve is rotating reserve (a some amount of fuel is burning) without power delivery to consumer. Power may increase 1-2% (of max power) per minute. The cold reserve is not rotating. Starting time is about 2-6 hours)

Depending on the time of the day, import of capacity in heating season amounts to 500-870 MW.

Repairs and unevenness of consumption lead to low coefficient of use of installed capacity. Average time of operation of energy blocks amounts to circa 3,900 hours per annum (Coefficient of use of installed capacities reached almost 45%).

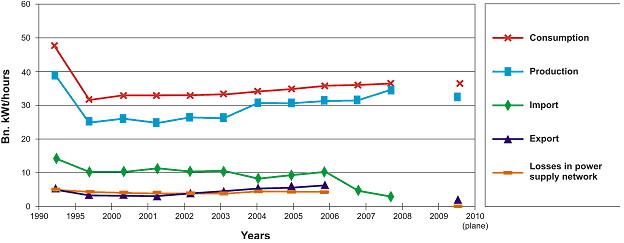

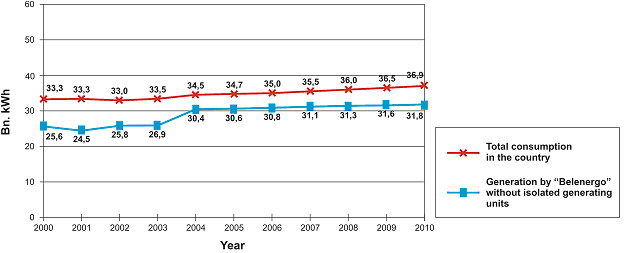

Figure 3 - Balance of Electric Power in the Republic of Belarus, source: State Statistics Committee of Belarus

Figure 3 - Balance of Electric Power in the Republic of Belarus, source: State Statistics Committee of Belarus

Traditionally the Republic of Belarus fails to provide itself with electric power, covering the shortage through import, mainly from Russia and Lithuania, in parallel ex-porting electric power, mostly to Poland. Growth of production by 12.6% in 2004 re-sulted in increase of export rather than decrease in imports.

Based on the Belarusian State Statistics Committee data, in 2006 total consump-tion of electric power in Belarus amounted to 36.2 bn. kWh, including 31.6 bn. kWh of electric power generated by “Belenergo” Concern power plants, export – 5.8 bn. kWh and import – 10.1 bn. kWh.

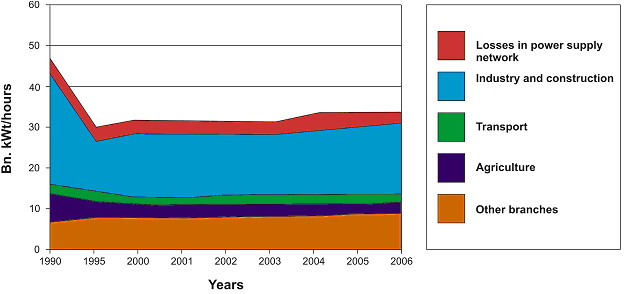

Figure 4 - Structure of Consumption of Electric Power in the Republic of Belarus

Figure 4 - Structure of Consumption of Electric Power in the Republic of Belarus

The Republic of Belarus is the only FSU state, which has the energy efficiency management system. On annual basis the companies are assigned with plans on energy saving. Reduction of GDP energy intensity amounts to about 6% per annum. During 2000-2005 the Belarusian GDP grew by 42%, whereas consumption of fuel during this period of time increased by 6%. During these years the objective was to reduce GDP total energy intensity by 20-25%.

Actual reduction amounted to 25.3% and plans for 2006-2010 envisage further re-duction of these indicators by 26-30%. Based on preliminary data, the 2007 saw reduc-tion of GDP energy intensity in Belarus by 7.5%, and the 2008 – by 8%. According to the Resolution of the Council of Ministers of the Republic of Belarus №1339, in 2009 it is planned to reduce energy intensity of industrial products by 9%, utility services – by 3%.

Figure 5 - Forecast of consumption of electric power in 2005

Figure 5 - Forecast of consumption of electric power in 2005

In 2005 it was envisaged to increase the use of local fuels by 340,000 tons. Actual growth amounted to 410,000 tons.

The forecast, made in 2005 [2], has been envisaging that in 2010 consumption of energy would reach 36.9 bn. kWh, in 2020 – 41 bn. kWh. This would require an increase in installed capacity by approximately 650 MW to 8,500 MW.

Table 2 - Structure of consumption of fuel oil in the Republic of Belarus with forecast till 2010. [2]

Types of energy resources 2004 2005 2006 2007 2008 2009 2010

Natural gas 22.8 22.8 22.4 22.51 22.75 22.77 22.7

of which as raw material 1.4 1.46 1.5 1.8 2.2 2.2 2.2

Fuel oil 2.14 1.60 1.7 1.7 1.75 1.73 1.55

of which from own oil (including solid residue of oil processing, starting from 2008) 0.90 0.90 0.90 0.90 0.90 0.90 0.90

Coal, including coke 0.28 0.15 0.16 0.17 0.18 0.19 0.20

Liquefied gas 0.33 0.33 0.32 0.32 0.31 0.31 0.30

Gas, generated by Oil Refineries 0.64 0.45 0.45 0.45 0.45 0.45 0.45

Domestic heating oil 0.11 0.09 0.09 0.09 0.09 0.09 0.09

Other local fuels – total 2.25 2.56 2.80 3.16 3.47 3.80 4.11

Including:

peat and lignin 0.60 0.75 0.94 1.07 1.13 1.15 1.18

Wood fuel 1.07 1.18 1.22 1.44 1.67 1.97 2.24

Continuation table 2

Other types of fuel 0.58 0.60 0.63 0.66 0.67 0.68 0.69

Total boiler house and fuel oil: 28.6 28.0 27.9 28.4 29.0 29.3 29.4

of which without raw materials 27.1 26.4 26.4 26.6 26.8 27.1 27.2

of which own boiler house and fuel oil taking into account gas generated by Oil Refineries, domestic heating oil and other products 3.55 3.86 4.09 4.45 4.75 5.07 5.37

Same, in percentage 13.1 14.6 15.5 16.7 17.7 18.7 19.7

Heat-recovering installations 0.62 0.64 0.69 0.72 0.74 0.76 0.78

Household waste, wind mills 0.01 0.01 0.01 0.02 0.02 0.02

Local resources consumed to generate power – total 4.17 4.50 4.79 5.18 5.51 5.85 6.17

Same, in percentage 15.4 17.0 18.1 19.5 20.5 21.6 22.7

Consumption of electric power, bn. kWh 34.46 34.7 35.0 35.5 36.0 36.5 36.9

Consumption of heat energy, mln. GCal 73.0 73.2 73.9 74.5 75.2 75.9 76.5

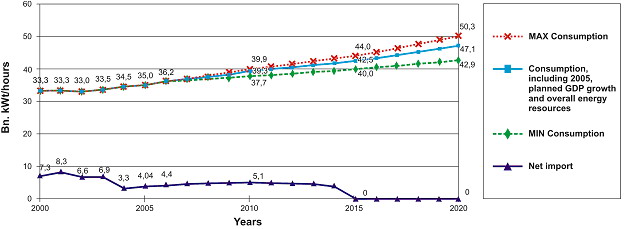

In early 2008 the Republican Unitary Enterprise “BelTEI” prepared a forecast of needs of the Republic of Belarus in energy till 2025. [20]. Energy consumption in 2020 was envisaged on the level of 47.1 bn. kWh, which would have required commissioning about 1,000 MW of additional capacities (figures 6 and 7).

Figure 6 - Forecast of “BelTEI” for consumption of electric power till 2020

Figure 6 - Forecast of “BelTEI” for consumption of electric power till 2020

The forecast was made, based on assumption that average annual growth of GDP rates for the period from 2005 to 2015 would amount to 7.9%, and 6% during 2015 – 2030. The obtained figure of GDP growth in Belarus corresponds to growth rates in China, which is unlikely to be achieved. As well, the forecast contains a disputed as-sumption that 1% of GDP growth leads to 0.3% growth of energy consumption. Eco-nomic crisis inevitably would introduce corrections into this forecast. During 2009-2010 GDP growth rates shall be expected close to zero, which from the point of view of energy efficiency measures would result in energy consumption decrease by about 6-8% per an-num .

Therefore, for the present note the forecast of energy balance is considered accord-ing to [2].

1.2. Sensitivity of the Belarusian economy to prices for natural gas

First of all, cost of production of electric power is determined by the price for natural gas. Based on data of the Republic of Belarus Ministry of Energy, average cost of production of electric power in the Belarusian energy system in 2007 was US$ 0.064 per kWh.

According to the natural gas supply contract, price for gas is linked to average European price taking into account lowering factor. Starting from Q2 2008 Belarus buys gas at the price of US$ 127.9 per 1,000 m3 [4]. According to the Government of Belarus, in 2009 average entry price for the Russian gas will reach US$ 148 per 1,000 m3. At the same time, in Q1 2009 price for gas will be much higher . By 2011 Belarus should be paying European price for gas.

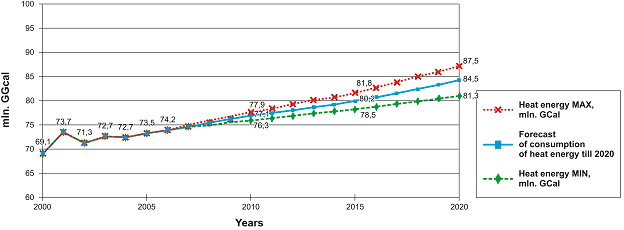

Figure 7 - “BelTeI” forecast of consumption of heat energy till 2020

Figure 7 - “BelTeI” forecast of consumption of heat energy till 2020

Modeling resulted in conclusion that if measures are not taken, in 5-7 years at the level of energy consumption that has taken shape static losses of well-being with prices for gas increasing up to US$ 230 per 1,000 м3 can make 20% in consumption and de-crease in gross domestic product by 15.7%. In this connection growth of economy ap-pears to be significantly dependent on amount and efficiency of use of natural gas.

2. Energy scenarios in the Republic Belarus

2.1. Nuclear Scenario

In Belarus construction of power station using nuclear fuel was started in 1983, when in the vicinity of Minsk erection of the Minsk Nuclear Power Plant began. Its ca-pacity should have reached 2,000 MW. Simultaneously consideration of the issue of con-struction of the second – Belarusian Nuclear Power Plant has started. After 1986 con-struction of Nuclear Power Plant was stopped and Minsk Thermal Power Plant No 5 has been constructed on the basis of Minsk Nuclear Power Plant, 70% of which had been completed by 1986.

In 1992, after USSR collapsed, the Government of Belarus had approved the pro-gram of development of energy sector and power supply till 2010. For the first time after accident at the Chernobyl Nuclear Power Plant in it a separate item had been stipulated an opportunity to build a Nuclear Power Plant in territory of Belarus.

The Resolution of Chairperson of the Republic of Belarus Council of Ministers, adopted on 31 March 1998 has led to creation of the Commission on Evaluation of Expe-diency of Development in Nuclear Engineering in Belarus. The commission consisted of 34 persons, and was headed by the Vice-President of the National Academy of Sciences, Mr. P. A. Vityaz. Having discussed the problem and ways of its solving, the majority of the commission`s members arrived at the following conclusion:

In 2008 leadership of the Republic of Belarus has returned to consideration of an opportunity to build nuclear power plant and on 31 January 2008 the Republic of Belarus Security Council has taken a political decision to build nuclear power plant in Belarus.

State Commission in charge of choosing a place of location of area to build an NPP in Belarus on 20 December 2008 has decided that nuclear power plant will be erected at Ostrovetskaya site in the Grodno Region. Minutes of the meeting of the State Commission and certificate of choosing the place of location of area to build a nuclear power plant were signed. The choice has been based on results of studying three areas: Ostrovetskaya in the Grodno Region, Kranopolyanskaya and Kukshinovskaya sites – in Chaussky and Shklovsky districts of the Mogilyov Region.

2.1.1. Description of Nuclear Scenario

In conformity with the scenario, in 2015 the first unit of the nuclear power plant and by 2020 the second power unit should be commissioned .

Based on calculations, made by the Republic of Belarus National Academy of Sci-ences, commissioning of nuclear power plant with total capacity of 2,000 MW into power supply system of the republic during 2016-2018 will provide for stabilization of cost of production of electric power in Belarus at the level of US$ 0.13 per kWh during 2025-2030, whereas with “gas” option of developing power supply system the costs will rise to the level of US$ 0.18 per kWh in 2025 and US$ 0.21 kWh in 2030.

![Figure 8 - Expected costs for generation of electric power [21] Figure 8 - Expected costs for generation of electric power [21]](http://greenworld.org.ru/sites/default/greenfiles/images/fig08.jpg) Figure 8 - Expected costs for generation of electric power [21]

Figure 8 - Expected costs for generation of electric power [21]

Authors [21] link reduction of tariffs with commissioning of the NPP first power generation unit.

Nuclear generation shall replace natural gas in the amount of 5 million tons of fuel equivalent. By 2020 the share of nuclear generation in total balance of fuel and heating oil will make 16%, in generation of electric power it would reach approximately 30-32%.

Table 3 - Forecast of structure of consumption of fuel and heating oil by 2020, based on scenarios of development with and without of NPP (in mln. tons of coal equivalent), based on state program of modernization of fixed assets 2005 [2]

| Types of energy resources | Years | |||||

|---|---|---|---|---|---|---|

| 2005 | 2010 | 2015 | 2020 | |||

| With NPP | Without NPP | With NPP | Without NPP | |||

| Natural gas | 22,8 | 22,7 | 23,01 | 20,51 | 24,23 | 19,23 |

| Including as raw materials | 1,46 | 2,2 | 3,0 | 3,0 | 3,0 | 3,0 |

| Fuel oil | 1,6 | 1,55 | 1,6 | 1,6 | 1,4 | 1,4 |

| Coal | 0,15 | 0,2 | 0,2 | 0,2 | 0,2 | 0,2 |

| Liquefied gas | 0,33 | 0,3 | 0,32 | 0,32 | 0,2 | 0,2 |

| Gas generated by Oil refineries | 0,45 | 0,45 | 0,45 | 0,45 | 0,45 | 0,45 |

| Domestic heating oil | 0,11 | 0,09 | 0,12 | 0,12 | 0,1 | 0,1 |

| Local and other | 2,56 | 4,11 | 5,75 | 5,75 | 6,3 | 6,3 |

| Including: | ||||||

| Peat and lignin | 0,75 | 1,18 | 1,3 | 1,3 | 1,4 | 1,4 |

| Wood fuel | 1,18 | 2,24 | 3,2 | 3,2 | 3,5 | 3,5 |

| Other types, including hydropower plants | 0,62 | 0,69 | 1,25 | 1,25 | 1,4 | 1,4 |

| Nuclear fuel | 2,5 | 5 | ||||

| Total | 28,0 | 29,4 | 31,45 | 31,45 | 32,88 | 32,88 |

| Purchased electric power | 1,54 | 1,4 | 1,26 | 1,26 | 1,12 | 1,12 |

| Total: | 29,54 | 30,8 | 32,71 | 32,71 | 34,0 | 34,0 |

Therefore, by 2020 pure growth of consumption of primary fuel and energy re-sources should make about 3.34 mln. tons of coal equivalent fuel (taking no account of natural gas as raw material and import of the electric power). This growth should occur due to local resources, basically peat, hydroelectric power stations and wood fuel. Ac-cording to the State Comprehensive Program of Modernization of Fixed Production As-sets in the Belarusian energy system, energy efficiency and increase in share of own fuel and energy resources used in republic in 2006-2010 (hereinafter the Program), envisages for increase in volume of production and consumption of local fuels and energy resources from circa 4.5 mln. tons of equivalent fuel in 2005 up to 6.17 mln. tons of equivalent fuel by 2010, including (in mln. tons of equivalent fuel):

| Wood fuel and waste of timber cutting | 2,24 |

| Peat and lignin | 1,18 |

| Other types of fuel | 0,69 |

| of which: | |

| Wood processing waste | 0,37 |

| Hydroelectric power station | 0,07 |

| Thermal secondary power resources | 0,78 |

| Household waste and wind turbines | 0,02 |

| Accompanying gas and products of processing of own oil | 1,26 |

According to the Program, it is envisaged to reduce, as well, energy intensity of GDP by 25-30% to the level of 2005.

Proceeding from the suggested scenario, by 2020 electric generation (41 bn. kWh/year) may look approximately as follows:

- NPP – 13.1 bn. kWh (with efficiency of use of installed capacity of 75%);

- Hydroelectric power station – 0.5 bn. kWh;

- Wind – 0.01 bn. kWh;

- Import – 3 bn. kWh;

- Turbine expansion engine installations (60 MW, with efficiency of use of in-stalled capacity of 60%) – 0.3 bn. kWh;

- Thermal power stations, using local fuels (17 MW by 2010, with efficiency of use of installed capacity of 60%) – 0.1 bn. kWh;

- Fuel oil – 1.7 bn. kWh;

- Natural gas (approximately) – 22.3-25.3 bn. kWh (with and without import taken into account).

As it is evident from the referred estimates, the scenario assumes exceptionally low involvement of renewable sources of energy into generation of electric power – 0.9 bn. kWh or 2.1% of total amount of generate electric power by 2020 (taking into account turbine expansion engine installations). The largest part of energy, based on local fuel and energy resources is intended for generation of energy for heating.

Comparison of financial flows for nuclear and traditional gas scenarios, made in 2005 in Sosny Institute, has shown that economic benefit of construction of the nuclear power plant in comparison with construction of new gas-fired capacities is achieved only during 20-th year after commencement of construction [3].

2.1.2. Reduction of Consumption of Gas in the Nuclear Scenario

On the country level, by 2020 absolute reduction of consumption of gas in energy sector will make circa 23% – from 18.5 bn. m3 down to 14.1 bn. m3. Other sources [3] say that reduction will reach 20% – from 18.5 bn. m3 down to 14.9 bn. m3.

Specific (not absolute) reduction of gas consumption also will occur due to modernization of gas-fired capacities (including due to use of combined-cycle plant technologies) and increase of efficiency of electric power generation. According to forecasts about 2,220 – 3000 MW gas-fired capacities should be modernized, therefore burning the same volume of gas would result in increasing generation of electric power.

Based on the fact that the State Production Association “Belenergo” consumes 58% of all volume of gas including raw gas, at present “Belenergo” consumes now about 11.5 bn. m3 per annum of all volume of imported gas (19.8 bn. m3 in 2005). Reduction of gas consumption due to nuclear generation will result in decrease in gas consumption by “Belenergo” accordingly from 11.5 bn. m3 down to 7.2 bn. m3.

Thus, the aggregate heat of combustion of gas burnt by “Belenergo” in the nuclear scenario by 2020 will make 67 bn. kWh. Based on scenario’s 22.3-25.3 bn. kWh, which “Belenergo” will generate it is possible to evaluate approximately the efficiency of burn-ing of the remained volumes of gas: efficiency of electric power generation by burning gas will amount to circa 33.3-37.8%. This provides for potential of further decrease in consumption of gas, taking into account the best global practice .

Irrespective of the decision to build nuclear power plant the use of local fuel and energy resources would provide for a significant contribution to saving of natural gas – by replacing potential import of gas in the amount of 6.3 mln. tons of equivalent fuel by 2020.

2.1.3. Cost of Capital Construction in the Nuclear Scenario

According to the Russian government, the cost of nuclear generation in 2007 was RUR 55.7 bn. per 1,000 MW [5], which at the rate of US$ 1 (in 2007) equals RUR 26 making about US$ 2.14 bn. per 1000 МВт. Cost of construction of 2,000 MW capacity nuclear power plants (without an additional infrastructure) theoretically will result in US$ 4.28 bn. in 2007 prices.

Taking into account construction of infrastructure, additional expenses will amount up to US$ 1.5 bn. [7]. Total capital expenditures in this case will reach US$ 5.78 bn.

These costs do not include creation of additional hot reserve of capacities of 550 MW (US$ 0.8 bn.) and construction of hydro-accumulation (pumped storage hydro) power plant with 1 GW capacity. Cost of hydro-accumulation power plant depends on concrete site, but its construction can cost US$ 2 bn.

In the course of construction, undoubtedly, there will be a rise in price of construc-tion of nuclear power plant. The Russian experience shows that cost increase considera-bly exceeds inflation: more than two times in excess of the declared cost for 4 years of construction (as well, see section 4).

In order to evaluate the cost of capital in the construction of the nuclear power plant, it is possible to compare it with costs of activities in the field of energy efficiency and use of local fuels and energy resources. With aggregate consumption of fuel oil (28 mln. tons of coal equivalent in 2005, taking no account of gas used as raw material) total saving of power resources, resulting from energy saving activities at the end user stage by 2010 will amount to 4.6 mln. tons of coal equivalent 16% to the 2005 level).

Due to local fuel and energy resources it is envisaged to receive an additional 3.74 mln. tons of equivalent fuel of primary energy (6.3 in 2020 – 2.56 in 2005) that actually allows covering growing energy consumption without increasing consumption of natural gas. During 2006 – 2010 local fuel and energy resources are to provide an additional 1.67 mln. Tons of equivalent fuel (Table. 1) Cost of activities aimed at using local fuel and energy resources to 2010 amounts to US$ 0.75 bn. Economic benefit of replacement of imported gas of local fuel and energy resources (mainly, wood fuel) and activities in the field of energy efficiency is much higher compared with costs of construction of nuclear power plant .

Table 4 - Comparison of economic benefit in energy efficiency, based on use of own fuel and energy resources in 2006-2010 and construction of nuclear power plant

| Capital in-vestments, US$ mln. | Expected economic ef-fect, thousand tons of coal equivalent per an-num | Unit capital costs, US$/ton of fuel equiva-lent | |

|---|---|---|---|

|

Energy efficiency |

1852,2* |

4600,0* |

402,6 |

|

Local fuel and energy resources |

747,8* |

1380,0** |

542 |

|

NPP/ |

4280,0/ |

5000,0 |

856/ |

*Taking no account of “Belenergo” Concern facilities.

**Additional volume of replacement of imported fuel, obtained during 2006 – 2010.

Specific costs of energy efficiency activities are more than 2.2-3.3 times lower than construction of nuclear power plant, if recalculate cost of saving of 1 ton of equiva-lent fuel. Accordingly, introduction of local fuels and energy is 1.6-2.4 times cheaper than NPP construction.

To evaluate the cost of modernization and commissioning of new capacities in gas generation it is possible to use following data. Estimated cost of modernization of the Minsk thermal power station-3 with 230 MW capacities on the basis of combined cycle plants is US$ 160 mln. or US$ 700 per kW . On the other hand, according to practice of construction of combined cycle plants in Russia, now approximate cost of construction of combined cycle plants is RUR 37,000-38,000 per KW of installed capacity or about US$ 1,450/kW (with US$ 1 equal to RUR 26).

Thus, taking into account that till 2020 it is envisaged to modernize and commis-sion 2,220-3,000 MW of gas generation, the cost of modernization and commissioning of new capacities will be circa US$ 3.2-4.4 bn. in 2007 prices.

2.2. Innovation Scenario Based on Renewable Energy Sources

There is no officially recognized or seriously discussed non-nuclear scenario, based on significant share of renewable sources of energy . However, such scenario can be evaluated based on available data about renewable sources of energy potential, secon-dary resources and energy efficiency in gas generation.

2.2.1. Potential of renewable energy sources

Below there are various evaluations of potential of renewable sources of energy.

Table 5 - Evaluations of renewable sources of energy and secondary resources potential

| Type of resource | Technical potential [2] | Economic potential [2] | Technical potential (other sources, except [2]) | Economic poten-tial (other sources, except [2]) |

|---|---|---|---|---|

|

Wood fuel and wood processing waste, mln. tons of equivalent fuel |

6,6 |

3,06 |

4.45 [13] taking into account energy planta-tions (lower estimate) |

|

|

Hydrological resources |

2,27 bn. kWh |

0,39 bn. kWh |

0.11-0.15 mln. tons of equivalent fuel |

|

|

Wind energy potential, bn. kWh |

2,4 |

6,62 |

224 [9] |

2.24-15.65 [9] |

|

Biogas, obtained from processing of cattle breeding, mln. tons of equivalent fuel |

0,162 |

0,026 |

1,25-1,75 [13] |

|

|

Solar energy, mln. tons of equivalent fuel |

71 |

0,003 |

0,25-0,5 |

0.25-0.5 heat [13] 0.25 electric power [13] |

|

Household waste, mln. tons of equivalent fuel |

0,47 |

0,02 |

0.5 [13] (taking account of lignin and crop sector) |

|

|

Phytomass, mln. tons of equivalent fuel |

0,64 |

0,05 |

0,3 |

|

|

Lignin, mln. tons of equivalent fuel |

0,983/p> |

0,05 |

||

|

Crop sector waste, mln. tons of equivalent fuel |

1,46 |

0,02-0,03 |

||

|

Low potential heat of Earth of technological discharges, mln. tons of equivalent fuel |

1.4 (heat secondary resources) |

1,5-2 [13] |

||

|

Combustible secondary resources, mln. tons of equivalent fuel |

0,58 |

|||

|

Turbine expansion en-gines |

60 МВт |

0.25 mln. tons of equivalent fuel [13] |

||

|

Boiler house steam en-ergy |

0.32 mln. tons of equivalent fuel [13] |

In the nearest decades the most perspective directions of development of renew-able sources of energy are the wind energy and generation of energy, based on biomass.

2.2.2. Wind Energy

Prior to 1960-ies in territory of modern Belarus circa 20 thousand various wind energy generating units were in operation. The situation has sharply changed in 1960-ies when centralization of electric power supply has been carried out in all territory of the USSR, including Byelorussian Soviet Socialist Republic.

Opportunities of developing wind power engineering in the Republic of Belarus have been already examined. “Wind power generation in Belarus should develop more intensively and on the basis of experience already accumulated in the country”, – said Sergey Sidorsky, the Prime Minister of Belarus, taking the floor at session of Presidium of the Council of Ministers, considering the draft program of development wind power engineering branch in Belarus for 2008-2014 [22].

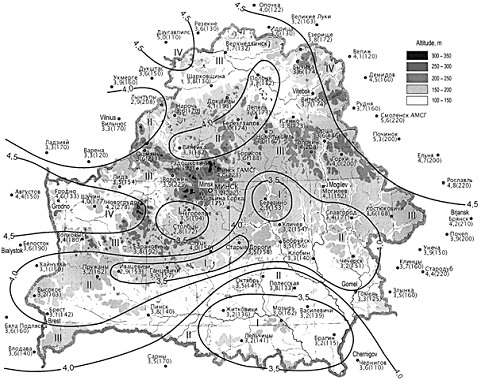

Annual wind power engineering potential, technologically accessible for use by existing wind energy generating units with nominal wind speed of 14 m/sec is evaluated circa 224 bn. kWh [9]. Regions with optimum wind conditions, with average annual speed of wind exceeding 5 m/s at height of 10 m above surface of the ground are Minsk, Vitebsk and Grodno [10]. Average speed of winds in Belarus in the winter is higher than in the summer and in the afternoon is higher than at night. Global climate change leads to increase in strong winds. Therefore in due course of time the potential wind power engi-neering will increase.

To specify places of location of existing wind energy generating units in other dis-tricts and regions there exists wind power engineering atlas developed by “Belenergoset-project” and wind power engineering databank developed by Scientific and Production Enterprise “Vetromash” [11]. In territory of Belarus there are 1,840 sites suitable for con-struction wind energy generating installations where 5 to 20 of such units can be placed at each site.

Figure 9 - Map of division into districts, based on wind speed in Belarus

Figure 9 - Map of division into districts, based on wind speed in Belarus

From technical point of view, it is believed that the share of unstable wind energy generating installations in the network should not exceed 30-40%. Assuming as basis the growth of power consumption in the Republic of Belarus up to 41 bn. kWh by 2020 and share of wind power in electric balance as 30% the volume of electric power that can be put into the network by wind energy generating installations in Belarus will make 12.3 bn. kWh. The volume of a wind resource offered for use is within economically accessible po-tential of wind power engineering in the Republic of Belarus – 15.65 bn. kWh [12].

Using wind energy generating installations with individual capacity of 2 MW, generating 3.5 mln. kWh per annum at average annual wind speed of 5.7 m/sec at height of 30 m above the surface to achieve the objective (12.3 bn. kWh) it is necessary to commission 3,514 wind energy generating installations with aggregate installed capacity of 7,028 MW.

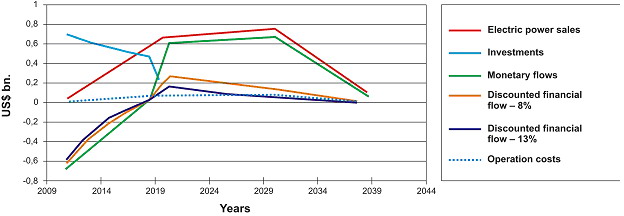

Results of calculation of financial flows are provided below to evaluate costs of wind generation for 7,028 MW wind energy generating units with the following assump-tions:

- Manufacturing and erecting of installations – 10 years,

- Initial cost of wind energy generating unit – US$ 1,000/ kW (the price achieved in Western Europe in 1998);

- Annual reduction of costs for manufacturing – 5% ;

- Wind energy generating unit service life of 20 years and then dismantling. Cost of dismantling is 6% of wind energy generating unit cost, proceeds from recycling scrap metal – 8%.

Figure 10 - Proceeds (financial flow) for wind energy generating unit with 7,000 MW capacity

Figure 10 - Proceeds (financial flow) for wind energy generating unit with 7,000 MW capacity

Calculations show that payback of the project will happen 10 years after com-mencement of construction, which is comparable with time of payback of nuclear genera-tion. The cost of generation of electric power without cost of financial services would be US$ 0.0301 /kWh.

Use of wind potential in the proposed volume allows excluding construction of nuclear power plant and reducing consumption of imported natural gas by approximately 4.1 bn. m3 .

As the cycle of construction wind energy generating unit takes less than a year it is possible to adjust promptly commissioning of wind energy generating capacities depend-ing on dynamics of energy consumption. Experience of Germany shows that if generation of electric energy by wind power stations does not exceed 14% of the total generation in the system, then to compensate for dip in generation in windless weather no reserve ca-pacities are required. For the wind-generated energy exceeding 14% in the energy sys-tem, the volume of reserve capacities ranges between 8 and 15.3% from the wind power stations, i.e. 300-570 MW.

As well, it is expedient to manufacture wind energy generating units for small wind speeds (with vertical axis). In this case Belarus receives both: an independent en-ergy source, reduction in import of fuel and energy resource and an opportunity to export wind energy generating units, first of all, to Russia. Horizontal axis wind energy generat-ing units prevailing in the world are designed for higher wind speeds and are almost not appropriate for Central Russia conditions.

2.2.3. Use of Biomass in Generation of Energy

Use of waste, generated by wood processing and agriculture as fuel can provide at least 3 mln. tons of equivalent fuel. According to [13], this amount can grow to 4.45-8.9 mln. tons of equivalent fuel solely in forestry (basically due to energy plantations). Birch, willow, poplar, spruce and pine are considered plantation cultures.

According to [2], it is envisaged to use, as well, biomass of fast-growing plants at depleted peatlands of 180,000 hectares. Here it is planned to receive up to 0.3 mln. tons of equivalent fuel of biomass or 1.7 tons of equivalent fuel per hectare per annum. For-eign experience of cultivation of energy cultures shows that it is possible to get 5-6 tons of equivalent fuel per hectare. Thus, using the best practice of cultivation of energy cul-tures it is probable to get from the depleted peatlands up to 1 mln. tons of equivalent fuel of biomass. In case 1 mln. hectares is used to cultivate energy cultures (about 5% of the Republic of Belarus territory) it is likely to receive additionally circa 5 mln. tons of equivalent fuel.

The Republic of Belarus has a significant potential of animal breeding waste. Cal-culation of technical potential of biogas generation based on animal breeding waste is presented in the table.

Table 6 - Calculation of technical potential of biogas generation,

based on animal breeding waste [13]

| Store-cattle | Milk cows | Pigs | Poultry | Total | |

|---|---|---|---|---|---|

| Manure output, kg/capita per day | 50 | 45 | 3,5 | 0,3 | |

|

Biogas output, m3/capita per day |

2,43 | 1,62 | 0,2 | 0,02 | |

|

Head of livestock, mln. heads (in 2007) |

2,5 | 1,45 | 3,5 | 29,4 | |

|

Manure output, mln. tons per annum |

45,6 | 23,8 | 4,5 | 3,2 | 77,1 |

|

Biogas output, bn. m3 per annum |

2,2 | 0,9 | 0,26 | 0,2 | 3,5 |

|

Biogas output, mln. tons of equivalent fuel |

1,3 | 0,5 | 0,15 | 0,1 | 2,1 |

According to [13], economically accessible potential of biogas is 1.25-1.75 mln. tons of equivalent fuel.

In addition to biogas, manure processing results in production of fertilizers. Com-pared with fertilizers received from manure in usual way, productivity increases by 10-15%. Production of fuel, decrease in environmental pollution and production of fertilizers make generation of biogas from manure and vegetative waste economic already today. Experts of the republic should take a closer look at experience of Republic of Tatarstan, where majority of farms are equipped with biogas installations.

2.2.4. Potential of Energy Efficiency in Gas Generation

Efficiency of modern use of natural gas in the Republic of Belarus can be evalu-ated on example of State Production Association “Belenergo”, which is the major con-sumer of natural gas in the Republic of Belarus, consuming about 11.5 bn m3 per annum.

Total heat of combustion of gas, used by the State Production Association “Belen-ergo”, with heat of combustion 1 m3- 9.4 kWh is 108.1 bn. kWh. The State Production Association “Belenergo”, generating practically all electric and almost half of thermal energy, per annum supplies about 30.37 bn. kWh of electric energy). The share of gas in fuel balance of the State Production Association “Belenergo” amounts to 95.7% [2]. Based on this, it is possible to evaluate that combustion of gas results in generation of 29 bn. KWh of power. Average efficiency of electric energy in gas generation is 26.9% that is a low parameter, as efficiency of electric energy in gas generation can reach 60% in condensation mode and 40% in cogeneration mode.

The State Research and Development Enterprise “Zorya – Mashproject” already accumulated successful experience of modernization of steam-power units of Bere-zovskaya State District Power Plant (Beloozersk, Brest region). From July 2003 till December 2004 the power plant underwent installation and commissioning as gas-turbine superstructure to existing boilers PK-38R – 4 gas-turbine units GTE-25 25 MW each. The State District Power Plant capacity went up from 330 to 420 MW and the total con-sumption of fuel gas grew only by 5%. Specific consumption of equivalent fuel de-creased from 370 grams of equivalent fuel per kWh down to 307 grams of equivalent fuel per kWh.

Based on example of modernization of the Minsk thermal power station-3 it is possible to show that decrease in specific consumption can make from 320 grams/kWh at efficiency of 36% down to 179.2 grams/kWh with efficiency of 52-54%.

The installed capacity of gas generation (which will be presented mainly by ther-mal power plants) to generate 14.1 bn. kWh in the innovative scenario will require circa 3,500 MW with coefficient of use of installed capacities of 45%. Increase in efficiency of new capacities from 26.9% to 40% can save at the referred volume of generation of elec-tric power 1.8 bn. m3 of gas or 2.1 mln. tons of equivalent fuel. Taking into account in-crease the coefficient of fuel use supply of heat by thermal power plant would not be re-duced.

2.2.5. Description of Innovation Scenario

Proceeding from the proposed potential of renewable sources of fuel, by 2020 bal-ance of fuels and energy resources in energy sector can look approximately as follows:

- Fuel oil – 1.4 mln. tons of equivalent fuel;

- Coal – 0 mln. tons of equivalent fuel;

- Liquefied gas – 0.2 mln. tons of equivalent fuel;

- Gas, generated by Oil refineries – 0.45 mln. tons of equivalent fuel;

- Domestic fuel oil – 0.1 mln. tons of equivalent fuel;

- Peat and lignin – 0.75 mln. tons of equivalent fuel;

- Wood fuel – 4.45 mln. tons of equivalent fuel;

- Biogas – 1.25 mln. tons of equivalent fuel;

- Plant growing waste – 1.46 mln. tons of equivalent fuel;.

- Wind engineering – 12.3 bn. kWh – 4.3 mln. tons of equivalent fuel;

- Turbine expansion engines – 0.65 bn. kWh – 0.25 mln. tons of equivalent fuel;

- Turbines in boiler houses – 0.85 bn. kWh – 0.32 mln. tons of equivalent fuel;

- Heat utilization units – 2 mln. tons of equivalent fuel;

- Hydropower plants – 0.4 bn. kWh – 0.15 mln. tons of equivalent fuel;

- Import of electric power – 1.12 mln. tons of equivalent fuel;

- Natural gas – 10.7 mln. tons of equivalent fuel;

- Potential of energy efficiency in gas generation of electric power (increase of ef-ficiency in generation of 14.1 bn. kWh from 26.9% to 40%) – 2.1 mln. tons of equivalent fuel.

Total – 28.9 mln. tons of equivalent fuel taking into account use of potential of energy efficiency in generation of electricity.

Taking into account phytomass (energy cultures) which can be grown at depleted peatlands and others places, renewable sources of energy potential can be increased by some mln. tons of equivalent fuel.

Balance in electric power engineering, based on envisaged consumption 41 bn. kWh by 2020, may look as follows:

- Fuel oil – 1.7∙bn. kWh;

- Wood fuel – 2.5 bn. kWh (based on consumption of 1.25 mln. tons of equivalent fuel by thermal power plants and 3.2 25 mln. tons of equivalent fuel in boiler houses) .

- Biogas – 2.5 bn. kWh;

- Plant growing waste – 3 bn. kWh ;

- Wind turbines – 12.3 bn. kWh;

- Hydropower plants – 0.4 bn. kWh;

- Turbine expansion engines – 0.65 bn. kWh;

- Steam generated by boiler houses – 0.85 bn. kWh;

- Import – 3 bn. kWh;

- Natural gas – 14.1 bn. kWh.

2.2.6. Cost of Capital Construction in Innovation Scenario

Cost of wind energy generating units with aggregate capacity circa 7,028 MW is US$ 7 bn.

Specific cost of biogas installations amounts to US$ 2,000 per KW. Based on gen-erating 2.5 bn. kWh (circa 380 MW with efficiency of use of installed capacities of 75%) the cost of biogas installations would be US$ 0.76 bn. At the same time due to produc-tion of fertilizers the payback period for biogas installations decreases considerably and may take several months.

Cost of thermal power plant using wood raw material and waste of plant growing can be compared with the cost of coal-fired thermal power plants – US$ 2500 per kW. Taking into account generation of 5.5 bn/ kWh using wood and waste of plant growing the required capacity would be 840 MW with efficiency of use of installed capacities of 75% worth US$ 2.1 bn.

Based on calculation of US$ 1,450 per KW, cost of modernization and/or commis-sioning of new 3,500 MW capacities, based on cogeneration units would be US$ 5.08 bn.

2.3. Summary Data on Nuclear and Innovation Scenarios

To simplify comparison, identical parameters of absolute growth of energy con-sumption are adopted in both scenarios: growth of consumption of electric energy from circa 34 bn. kWh to 41 bn. kWh in 2020 and growth of consumption of primary resources in fuel oil balance from 28 mln. tons of equivalent fuel up to 31 mln. tons of equivalent fuel.

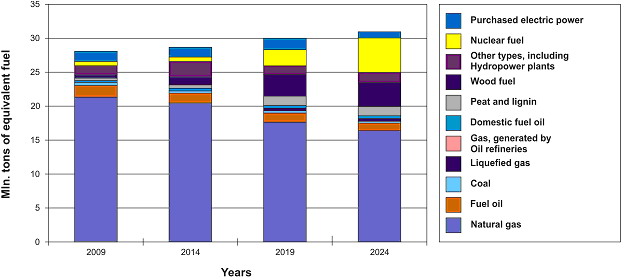

Figure 11 - Nuclear Scenario, balance of domestic fuel oil, (mln. tons of coal equivalent)

Figure 11 - Nuclear Scenario, balance of domestic fuel oil, (mln. tons of coal equivalent)

The nuclear scenario does not provide for cardinal escape from gas dependence – decrease in consumption of gas is 23%. At the same time, there is a necessity of solving the problems traditionally inherent for atomic engineering (see Section 4).

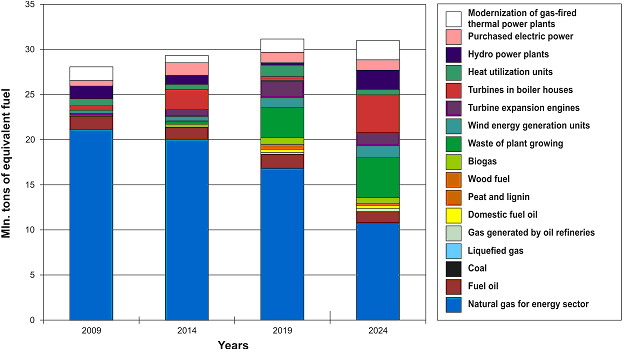

Figure 12 - Innovation Scenario: balance of fuel oil (in mln. tons of equivalent fuel)

Figure 12 - Innovation Scenario: balance of fuel oil (in mln. tons of equivalent fuel)

Cost of capital construction in electric power industry (on available data) is taken for evaluation of cost of scenarios.

Table 7 - Comparison of the nuclear and innovative scenarios in the Belarusian electric power industry till 2020

| Nuclear scenario com-missioned / upgraded capacities, MW | Innovation scenario commissioned / up-graded capacities, MW | Costs of capi-tal construc-tion, US$ per KW | |

|---|---|---|---|

| Gas generation | 3000 | 3500 | 1450 |

| Nuclear generation | 2000 | 0 | 2140 |

| Wind energy generating units | 5 | 7000 | 1000 |

| Biogas installations | 0 | 380 | 2000 |

| Generation using waste wood and plant growing waste | 0 | 840 | 2500 |

| Peat and lignin | No data | No data | |

| Hydro power plants | No data | No data | |

| Turbine expansion engines | 60 | 100 | No data |

| Steam energy of boiler houses | No data | No data | No data |

| Solar energy | 0 | No data | No data |

| Cost of investments in US$ bn. | 8,63/10,9* | 14,9 | |

| Amount of replaced gas in energy sector, in bn. m3 | 4,35/4,23** | 9,2 | |

| Specific cost of the replaced gas, US$ bn/bn. m3 | 2/2,6*** | 1,6 |

*Taking into account infrastructure and additional hot reserve

**Taking into account gas to ensure additional hot reserve (about 0.12 bn. m3)

***Taking into account cost of infrastructure, additional hot reserve and gas volume to ensure additional hot reserve

In the innovative scenario within 15 years decrease in consumption of gas in en-ergy sector is considerably higher than in nuclear, – almost by 50% or 9.2 bn. m3 from 18.5 bn. m3 to 9.3 bn. m3.

The innovative scenario appears to be more expensive that the nuclear one in abso-lute values because it allows saving almost 5 bn. m3 of natural gas more than the nuclear scenario.

If recalculated by specific cost of saving of gas volume unit, the innovative sce-nario appears 20-40% cheaper. It is proved to be true by official data of cost of using own fuel and energy resources, in which a significant share is taken by renewed sources.

Use of one of the Kyoto protocol financial mechanisms – projects of joint imple-mentation can become an additional source of financing for the innovation scenario. In the cost of reduction of emissions, where 1 ton of CO2 is worth US$ 10, the sum received under project of joint implementation for use of biogas would reach US$ 250 mln.

Taking into account specific expenses accompanying the nuclear scenario, the in-novative scenario becomes even more attractive.

From the point of view of cost of generated electric power, both scenarios are comparable. However, taking into account economic risks, fuel restrictions, subsidizing of atomic engineering the innovative scenario is, at least, more stable.

Table 8 - Comparison of economic effect of using own fuel and energy resources (for 2006-2010) and construction of NPP (based on the data of the Republic of Belarus Government, [2, 9])

| Capital invest-ments, in US$ mln. | Expected economic effect, in thousand tons of equivalent fuel | Specific capital in-vestments, in US $ / tons of equivalent fuel | |

|---|---|---|---|

| Local of fuel and energy re-sources | 747,8 | 1380,0 | 542 |

| NPP/NPP + infrastructure | 4280,0/5780,0 | 5000,0 | 856/1156 |

3. Correctness of economic calculations in the course of taking decision to build a nuclear power plant in the Republic of Belarus

Political decision to build a nuclear power plant in the Republic of Belarus was accompanied by economic calculations and scientific estimates. According to estimates of experts of the Sosny Institute of Power and Nuclear Researches [3], the nuclear sce-nario is cheaper from the point of view of long-term macroeconomic parameters in com-parison with modernization of gas generation, based on combine-cycle plant technolo-gies. According to point of view of the National Academy of Sciences [8], the nuclear power plant stabilizes the cost price of the electric power in the Republic of Belarus en-ergy supply system at the level of US$ 0.13 per kWh rather than the predicted US$ 0.18-0.21 per kWh by 2025-2030 in the “gas” scenario [8].

However, estimates of experts justifying advantage of construction of the nuclear power plant contain a number of basic discrepancies which demands additional calcula-tions and double checking of the received results.

Choosing alternatives. As it is mentioned in [7], for the last 25 years in no coun-tries of the world with market economy any private company has dared investing in nu-clear engineering without support of the state or without granting guarantees of purchase of the generated energy. In Russia the program of support of nuclear engineering pro-vides for allocation of circa RUR 1 trillion (US$ 40 bn. in the 2008 prices).

The guarantee of purchase of the generated energy means that the power supply companies should buy energy of the nuclear power plant, even if it is going to be more expensive than energy of other power plants. This fact best of all testifies that statements about the low cost price of nuclear energy are not always fair.

Comparing cost of construction of nuclear power plants and combined cycle plants. The comparative characteristic of nuclear power plant and combined cycle plants is very important in choosing energy sector scenarios. Economic preference of this or that scenario depends on what primary capital investments are required to develop gas and nuclear generation.

In the proposed nuclear scenario the cost of nuclear power plant is obviously un-derestimated. According to the point of view of experts of the Sosny Institute of Power and Nuclear Researches [3], specific cost of combined cycle plants is almost equal to capital construction cost of the nuclear power plant of US$ 1,116 per kW against US$ 1,126-1,299 per kW for combined cycle plants. At the same time, data for nuclear gen-eration is taken as of 2000 while cost of combined cycle plants is referred to as of 2007-2008 and even this figure is, most likely, overestimated taking into account experience of construction of combined cycle plants in the Republic of Belarus.

Technical and economic characteristics of 30 year old equipment are used for comparison. (Shlyakhin P.N. Steam and Gas Turbines, M, “Energy”, 1974). During this time characteristic of gas turbines and especially combined cycle plants have been im-proving much faster in comparison with “purely” steam ones, including for nuclear power units. World experience of construction of nuclear power plants show that cost of construction of nuclear power units 1.5-2 times exceed the cost of construction of com-bined cycle plants.

By the way, trends of growth of cost of these two technologies, on the example of foreign experience show that this gap increases. For example, according to Cambridge Energy Research Associates Inc. report from 2000 to early 2008 materials for construc-tion of nuclear power plant have grown by 173%, whereas for gas only by 92%.

Growth of cost of nuclear power plant during construction. In the course of con-struction cost of nuclear power plant grows taking into account growing requirements to safety of nuclear power plants, and initially underestimated cost of capital investments. As a result, during construction of the nuclear power unit, which takes 5-7 years, the cost of nuclear generation, grows considerably. For example, the cost of construction of third unit of the Kalininskaya nuclear power plant has exceeded the estimated one by 110% (see Section 4)

Growth of cost during construction is a very important factor in evaluating pay-back and profitability of nuclear projects. So, analysis of sensitivity of the project to in-crease in volume of capital investments into construction of the nuclear power plant (2 power units VVER-1000) is prepared for the second stage of the Balakovskaya NPP. Analysis, executed by authors of the Balakovskaya NPP project has shown that the pro-ject has a net discounted income equal to zero with increase in volume of capital invest-ments into industrial construction by 60% [14]. In case of construction, for example, of the third unit of the Kalininskaya NPP the excess was 110%.

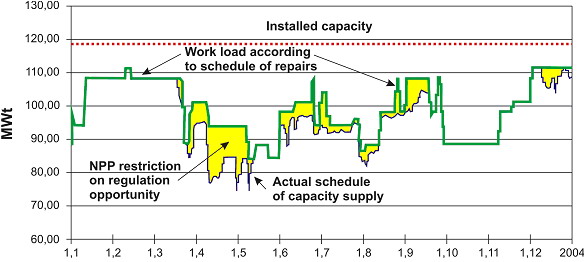

Taking account of natural gas required to increase hot rotating reserve. The nu-clear power plant should work in base mode, and is not designed to regulate capacity of power supply system. In such mode there are no restrictions on speed of dumping load, however, the rise of load is carried out very slowly, by steps with time delay at each step to prevent damage to fuel. Therefore, the number of unloading of units is very limited and intended mainly for scheduled and emergency dumps of loading or stopping units in case of equipment is damaged. According to the National Joint Stock Energy Company “Energoatom”, the number of regime unloading of units of the nuclear power station in Ukraine within the year ranges between 0 and 4 – 6.

Figure 13 - Load of NPP in Ukraine in 2004 in accordance with actual repairs. Source:

Figure 13 - Load of NPP in Ukraine in 2004 in accordance with actual repairs. Source:

website of the “Energorynok” State Enterprise

Now capacity of the largest power units in “Belenergo” is 330 MW. After com-missioning in 2010 of PGU-450 combined cycle plant at the Minsk thermal power plant-5 capacity of the largest unit will reach 450 MW. Construction of the nuclear power plant with 1,000-1,150 MW capacity of power units will demand creation of additional hot re-serve of at least 550 MW.

When equipment is in hot reserve (with 50% of nominal capacity) the consump-tion of fuel increases approximately by 10%, i.e. the 1,000 MW of hot reserve consumes 260,000 tons of equivalent fuel per annum. In this connection it is necessary to introduce a correction into calculation of fuel balance of the republic by quantity of additional gas required to maintain a reserve for the nuclear power plant – circa 140,000 tons of equiva-lent fuel per annum.

Taking account of cost of regulating capacities. Integration of nuclear generation of approximately 25% of total installed electric capacity with share in generation of elec-tric power of 32% is a complex technological task. According to [2], it will lead to com-plexity in passing daily dips, necessity to build special regulating capacities (pumped-storage hydropower plants, heat accumulators, etc.) Cost of regulating capacities, as well, should be considered in the nuclear scenario.

In this situation in Ukraine, operational planners of the State Enterprise “Ener-gorynok” and National Energy Company “Ukrenergo” have to envisage within a year re-strictions of generation of the nuclear power plant, even with minimizing of load on thermal power plants below minimum level – admissible for “survivability” of plants.

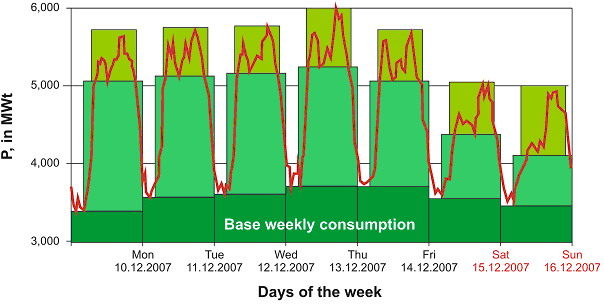

Figure 14 shows that base loading in the Republic of Belarus is circa 3,300 MW. Peak loads show extent of acuteness of future problem of daily and weekly regulation of capacity of gas-fired thermal power plants with commissioning of the 2000-2300 MW nuclear power plant.

Figure 14 - Typical weekly schedule of electric load of united energy system of Belarus in heating season (2007)

Figure 14 - Typical weekly schedule of electric load of united energy system of Belarus in heating season (2007)

Taking into account an average regulating opportunity of condensing plants units at the level of 0.46 construction of nuclear power plant, as well, will require construction of hydro-accumulating power plant of at least 1,000 MW capacity.

Evaluating costs of nuclear power plant tariff taking account of international experience. According to the data provided in [8] with reference to the International Atomic Energy Association, at present, the cost price of electric power, generated by nu-clear power plants in France is € 0.0254 and €0.393 per kWh at discounting rate of 5 and 10% accordingly.

However, in practice it is far from being like this. In 2008 growth of cost of reac-tor under construction in Flamanville (France) by 20% from €3.3 to 4 bn., Areva Com-pany has increased the predicted cost of the marketed electric power from €0.046 to €0.054 per kWh that is obviously higher than the declared of € 0.0254 – €0.393 per kWh.

Concerning cost of energy of the Russian nuclear power plants abroad it is neces-sary to refer to results of the recent tender for construction of the nuclear power plant in Turkey where the Russian company Atomstroyexport turned out to be the only partici-pant of the tender. The Atomstroyexport bid quoted the price of US$ 0.2079 per kWh for the supplied electric power from the Russian designed power units. Even if the discount rate is taken into account the cost price with such supplied price will obviously exceed the threshold of “stabilizing cost price” of US$ 0.13 per kWh. In this connection expert community in the Republic of Belarus should investigate a situation around the tender for construction of the nuclear power plant in Turkey and [find out] the reason of difference between cost price of the Russian designed nuclear power plants in Russia and abroad.

At the same time it is necessary to consider the indisputable fact that growth of nuclear power plants tariff in Russia is restrained inter alia due to numerous subsidies. Underestimation of share of subsidies in nuclear engineering in calculations of the Bela-rusian experts leads to erroneous estimates of the nuclear power plant tariff. Among the schemes of subsidizing of the Russian energy sector it is necessary to allocate at least the following:

- Direct budget subsidies,

- The foreign assistance,

- Tax privileges.

Annually the Russian Federation Federal Budget allocates significant means to atomic engineering within the framework of Programs, like “Safety of Nuclear Industry of Russia”, “Safety of Nuclear Power Plants and Research Nuclear Installations”, “Safety and Development of Atomic Engineering”. In total within the framework of these pro-grams up to RUR 2.5 bn. was allocated annually (data as of 2004). Till 2015 circa RUR 700 bn. of budgetary resources will be allocated solely for construction of new nuclear power plants within the framework of one more program, aimed at development of nuclear complex.

One more example of direct subsidizing, which is possible to refer to, is maintain-ing, at the expense of the state of the internal forces military units providing physical pro-tection of NPPs and nuclear technological cycle objects. It is difficult to evaluate the volume of resources to maintain military units, however to protect each NPP circa one company of internal forces is required. Much more servicemen are needed to protect some of the nuclear technological cycle enterprises. For example, protection of Mountain and Chemical Plant is protected by internal forces regiment.

Within the framework of foreign gratuitous assistance Rosatom receives or re-ceived assistance within the following (but far from limited to) international programs:

- Swedish International Project;

- European Commission ТАCIS Program;

- The USA International Program of Nuclear Safety;

- The Great Britain Nuclear Safety Program

Based on results 2003 activities took place within 152 international projects worth US$ 164 mln. In August, 2003 Finland solely allocated to “Rosenergoatom” circa RUR 300 mln. to improve safety of the Leningradskaya Nuclear Power Plant. In 2003 the German Government has allocated gratuitous assistance up to €7.02 mln. for implement-ing projects on physical protection of nuclear materials in territory of the Russian Federa-tion. According to Chamber of Accounts data, in 1998-2000 more than US$ 270 mln. was received from foreign states and organizations as international assistance to finance activities, related to disposal of radioactive waste.

Due to adoption of the Law “On Exemption of Property Tax of Enterprises, En-gaged in Storage of Radioactive Materials and Radioactive Waste”, amendments have been approved to the Russian Federation Tax Code, according to which organizations, engaged in storage of radioactive materials and radioactive waste, are exempted of prop-erty tax – 2.2% of the real estate cost. Taking into account solely the cost of property of operating storehouses, Rosatom can receive up to RUR 2 bn. of latent subsidies in the form of tax exemption.

Aggregate subsidies, taking into account failure to implement social programs, ac-cording to [16], reduce the cost price of nuclear energy approximately by 30%.

It is possible to state that similar schemes of subsidizing are envisaged in Belarus, as well. For example, according to the recently adopted Law of the Republic of Belarus “On Atomic Energy” it is assumed that “for a nuclear power plant or its unit a fund for decommissioning is formed due to the means received from sale of electric and thermal energy and rendering of other services, and due to other sources, which are not contradicting to the legislation”. Actually the Law opens a way to use budgetary funds to form the fund for decommissioning of the nuclear power plant from operation and other articles of expenditures, typical only for atomic engineering.

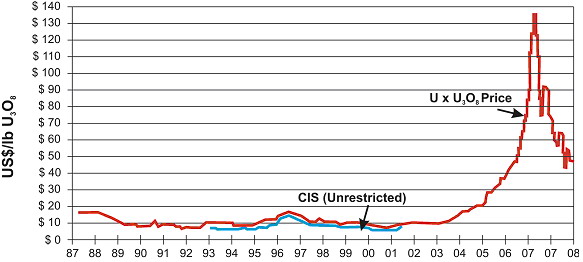

Figure 15 - Change of price of unenriched uranium (protoxide, U3O8) within 20 years till February 2009, US$/lb

Figure 15 - Change of price of unenriched uranium (protoxide, U3O8) within 20 years till February 2009, US$/lb

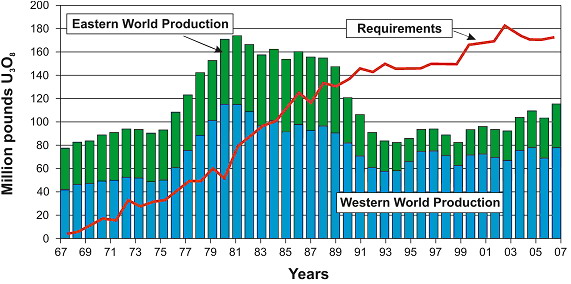

Evaluating growth of uranium fuel cost. According to [3], researches aimed at optimizing the Republic of Belarus power supply system adopted growth of fuel cycle cost by 0.5% per annum. Cost of fresh fuel approximately by one third is formed from cost of natural uranium. A stable price before, from mid 2003 natural uranium price has sharply grown from US$ 10-12/lb. to US$ 130/lb. by 2007 or more than 10 times (Fig. 15). And though the major growth has fallen on spot market of uranium, nevertheless, contract prices have grown considerably, as well. Shortage of supply in the natural ura-nium market the tendency of accelerated growth of cost of uranium is only becoming more expressed.

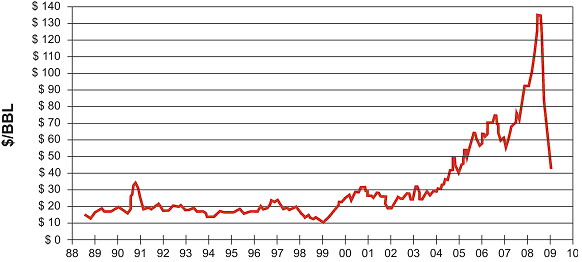

Figure 16 - Change in prices for oil during 20 years, US$/bbl

Figure 16 - Change in prices for oil during 20 years, US$/bbl

Figures 15 and 16 show that since 2004 the price for uranium grew together with oil price, and price for uranium began to fall prior to oil prices – since August 2007. However, if oil price has returned practically to initial condition, prices for uranium have remained at quite high level – as of 9 February 2009 uranium was worth US$ 48/lb. or 4 times higher than prior to 2003. Thus, it is possible to draw a conclusion, that the ura-nium market reflects objective tendencies of uranium price rise, connected with limited offer of uranium in the market.

The last 4-5 years markets of conversion and enrichment of uranium saw a proved significant growth.

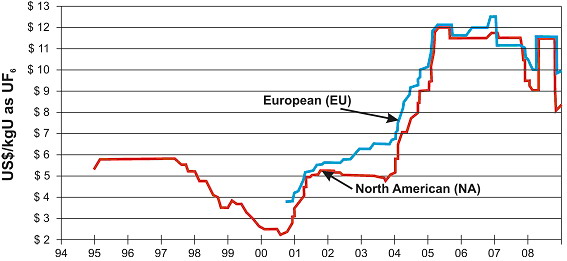

Figure 17 - Change of price for services to convert uranium U3O8 to UF6, US$ per kg UF6 for various processors

Figure 17 - Change of price for services to convert uranium U3O8 to UF6, US$ per kg UF6 for various processors

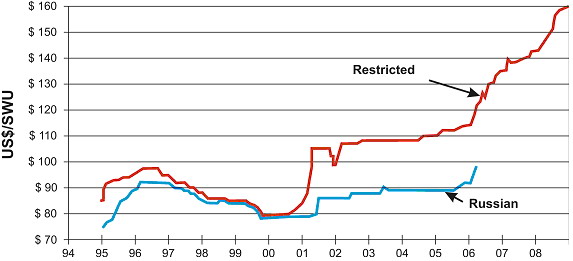

Figure 17 shows that cost of conversion since 2004 has grown from US$ 7 to ap-proximately US$ 10 per kg, an increase of more than 40% during 5 years. Cost of en-richment also experiences spasmodic growth – from US$ 110 to US$ 160 per unit of separation activities (since 2005 growth of approximately 45%).

Figure 18 - Change in prices for services to enrich uranium, US$ per unit of separation activities

Figure 18 - Change in prices for services to enrich uranium, US$ per unit of separation activities

On the background of reduction of prices for oil and natural uranium services on uranium enrichment continue to rise in price.

Evaluation of growth of cost of disposal of the depleted nuclear fuel. Speaking about cost of disposal of depleted nuclear fuel, it is necessary to note that here, as well a steady growth is observed exceeding 0.5% per annum. So, in 2009 Rosatom has in-creased prices for storage and reprocessing of depleted nuclear fuel from the Ukrainian nuclear power plants by approximately 17% from US$ 360 per kg to US$ 423 per kg.